BIR Orders Audit Suspension | PH

The BIR has suspended all field audits after the Department of Finance received rising complaints of abuse. Commissioner Charlie Mendoza said the move will allow…

The BIR has suspended all field audits after the Department of Finance received rising complaints of abuse. Commissioner Charlie Mendoza said the move will allow…

Since 2019, the ATO has received more than 300,000 community tip-offs, with major hotspots emerging across NSW, Victoria and Queensland. Reports often highlight suspicious activity…

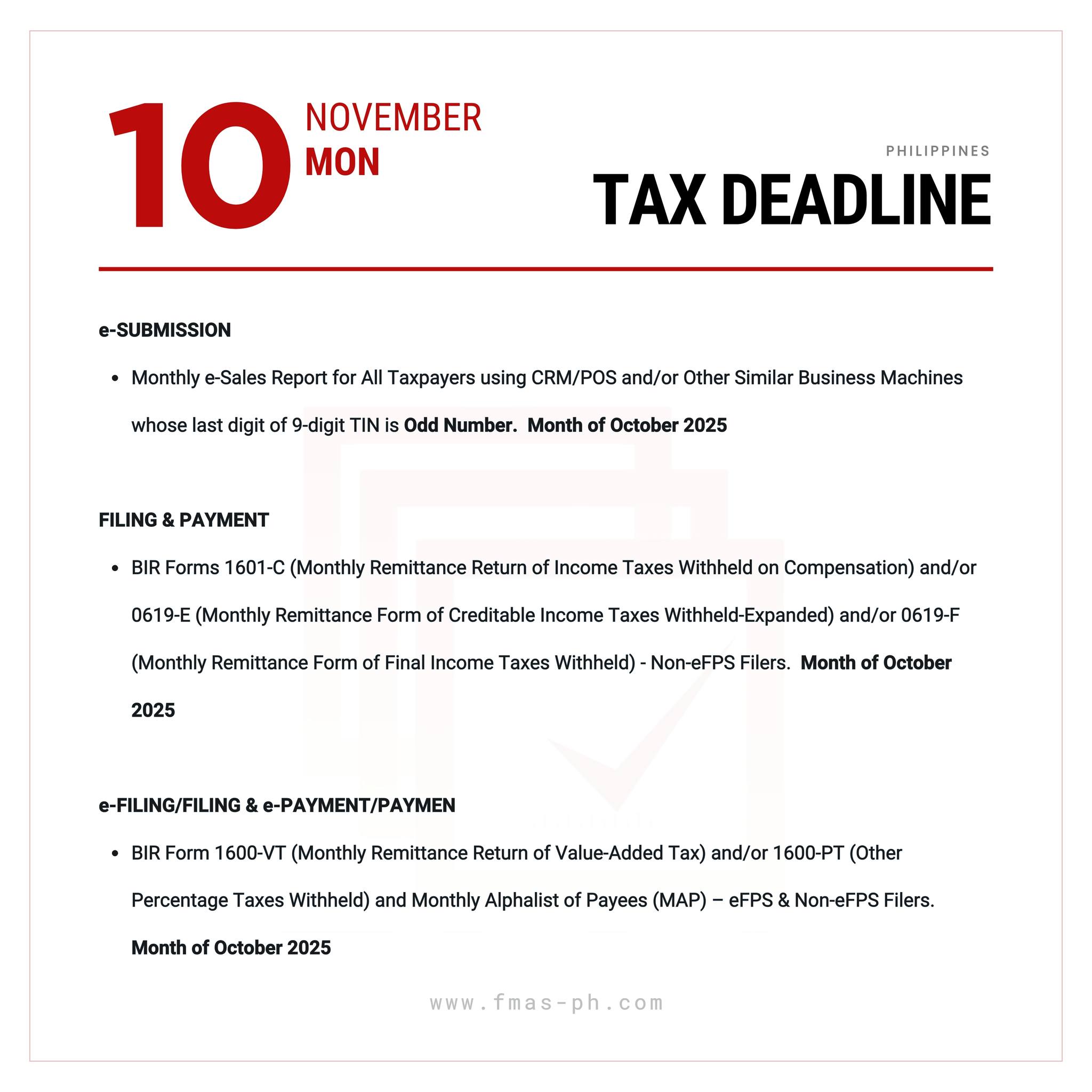

The deadline for the October 2025 BAS is just around the corner. Ensure your lodgment and payment are settled by 21 November to maintain compliance…

President Ferdinand “Bongbong” Marcos Jr. has appointed Charlito Martin Rada Mendoza to a new role at the Bureau of Internal Revenue, moving him from the…

Prepare your reports, keep your records organized, and double-check your entries so that everything is set for an efficient and well-prepared tax week. Stay on…

The ATO is encouraging Australians to check their accounts for lost or unclaimed superannuation, with millions potentially missing funds due to inactive accounts or outdated…